Defence Production in India: Record Growth and Strategic Transformation

Defence Production in India: Record Growth and Strategic Transformation

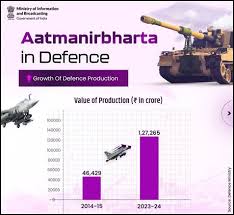

India’s domestic defence production in the financial year 2024–25 achieved an all-time high, crossing ₹1.51 lakh crore. This remarkable performance represents an 18% year-on-year increase compared to FY 2023–24 and an impressive 90% surge since FY 2019–20.

Such consistent growth reflects deepening industrial capabilities, a steady push towards indigenisation, and a strong alignment with the government’s Aatmanirbhar Bharat vision. India’s journey from a largely import-dependent defence market to a self-reliant and export-oriented producer has gathered unprecedented momentum over the last five years.

Understanding Defence Production in the Indian

Definition and Scope

Defence production refers to the design, development, and manufacturing of military systems including weapons, armoured vehicles, aircraft, naval ships, ammunition, electronics, and advanced surveillance systems for the armed forces as well as for export customers.

Key Contributors

India’s defence production ecosystem includes:

- Defence Public Sector Undertakings (DPSUs): Companies such as Hindustan Aeronautics Limited (HAL), Bharat Electronics Limited (BEL), and Mazagon Dock Shipbuilders.

- Ordnance Factories and Ammunition Plants: Now corporatised into seven entities under the Ordnance Factory Board (OFB) restructuring.

- Public Sector Enterprises: Non-DPSU firms with defence verticals.

- Private Sector Manufacturers: Increasingly contributing through innovation, technology partnerships, and niche product segments.

FY 2024–25 Snapshot

- Total Output: ₹1,50,590 crore.

- Sectoral Distribution: DPSUs and PSUs accounted for 77% of production, while the private sector’s share grew to 23% (from 21% last year).

- Exports: Reached ₹23,622 crore, a 12% increase over FY 2023–24, covering markets in Southeast Asia, Africa, and the Middle East.

Growth Trends: A Look at the Numbers and Patterns

Multi-Year Surge in Output

In FY 2019–20, India’s defence production was significantly lower. By FY 2024–25, production had nearly doubled, indicating sustained expansion rather than a one-off spike.

Year-on-Year Improvements

- FY 2023–24: ₹1,27,000 crore (approx.).

- FY 2024–25: ₹1,50,590 crore.

- Growth Rate: 18% in a single fiscal year, demonstrating resilience despite global supply chain disruptions.

Private Sector’s Expanding Role

Although DPSUs continue to dominate, the private sector’s gradual rise signifies a healthier, more competitive environment. Companies like Larsen & Toubro, Tata Advanced Systems, and Bharat Forge have entered high-value manufacturing domains such as missile systems, warship building, and aerospace components.

Policy Drivers Behind the Record Output

Aatmanirbhar Bharat in Defence

The government’s self-reliance policy has shifted procurement preferences towards “Made in India” solutions, limiting imports for items that can be indigenously produced.

Positive Indigenisation Lists

The Ministry of Defence has periodically released “Positive Indigenisation Lists”—catalogues of military equipment and sub-systems banned from import, ensuring local manufacturing opportunities.

Simplified Procurement Procedures

Reforms in the Defence Acquisition Procedure (DAP) have reduced red tape, introduced faster bidding cycles, and encouraged start-up participation under the iDEX (Innovations for Defence Excellence) framework.

FDI Liberalisation

Foreign Direct Investment (FDI) in the defence sector has been allowed up to 74% under the automatic route and 100% with government approval, attracting global manufacturers to set up local units.

Export Promotion Measures

Simplified licensing processes, export financing, and dedicated defence export cells have made it easier for Indian manufacturers to tap into foreign markets.

Defence Exports: Expanding India’s Global Footprint

Export Growth in FY 2024–25

Defence exports reached ₹23,622 crore, marking a 12% jump from FY 2023–24. This growth is significant given the competitive nature of the global arms trade.

Key Export Destinations

- Southeast Asia: Philippines, Vietnam (notably, the BrahMos missile system deal).

- Africa: Supplying armoured vehicles and small arms.

- Middle East: Supplying naval systems and surveillance equipment.

Notable Exported Products

- Offshore patrol vessels.

- Light combat aircraft components.

- Armoured personnel carriers.

- Artillery gun systems.

Challenges Hindering Further Expansion

Technology Gaps

Despite growth, India still depends on foreign suppliers for advanced propulsion systems, stealth technologies, and certain missile guidance systems.

R&D Funding Shortfalls

The proportion of defence budget allocated to research and development remains limited compared to leading military powers like the USA or China.

Supply Chain Vulnerabilities

Global disruptions—such as semiconductor shortages—can affect production timelines for advanced systems.

Export Barriers

Indian manufacturers face stiff competition from established arms exporters like the USA, Russia, and France, who have entrenched market positions.

The Road Ahead: Strategies for Sustainable Growth

Boosting Domestic R&D

Increased investment in DRDO and collaborations with academic institutions can reduce technology dependence and create cutting-edge solutions tailored for Indian conditions.

Strengthening Private Sector Participation

Expanding incentives, offering tax benefits, and facilitating technology transfers will further motivate private industry to scale up production.

Focus on High-Value Exports

Instead of primarily supplying low- to mid-value defence products, India should target niche high-value markets—like missile systems, radars, and advanced UAVs—where it has proven capability.

Building a Skilled Workforce

Specialised training programs for engineers, technicians, and operators in defence manufacturing can ensure quality standards and faster innovation cycles.

International Collaborations

Strategic partnerships with countries like Israel, France, and Japan can accelerate the adoption of advanced manufacturing techniques while opening new export markets.

Conclusion: India’s Rising Strategic Independence

The record-breaking defence production of ₹1.51 lakh crore in FY 2024–25 is more than a numerical achievement, it signals a paradigm shift in India’s strategic and industrial landscape. With supportive policies, a growing private sector footprint, and expanding exports, India is steadily emerging as both a global arms supplier and a nation less reliant on imports for its own security needs.

If current momentum is sustained and supported by enhanced R&D, workforce skill development, and global collaborations, India is well-positioned to join the ranks of the world’s top five defence manufacturers in the coming decade. This transformation not only strengthens the armed forces but also boosts economic growth, industrial innovation, and diplomatic influence