Open Market Operation (OMO) Purchase

08.12.2025

Open Market Operation (OMO) Purchase

Context

The RBI announced a ₹1 trillion OMO purchase along with a $5 billion dollar–rupee swap to inject durable liquidity into the banking system. This move came as the rupee weakened beyond ₹90/$, driven by persistent foreign portfolio outflows.

About Open Market Operation (OMO) Purchase

What is an OMO Purchase?

An Open Market Operation (OMO) purchase is a liquidity tool through which the RBI buys government securities from banks and financial institutions.

This injects durable liquidity into the financial system, increases bank reserves, softens short-term interest rates, and strengthens monetary policy transmission.

Purpose of OMO Purchases

- Inject Durable Liquidity: Ensures banks have long-term funds to support credit growth.

- Smooth Monetary Transmission: Helps policy rate changes translate into lower lending rates.

- Stabilise Money Markets: Keeps the Weighted Average Call Rate (WACR) aligned with the RBI’s policy repo rate.

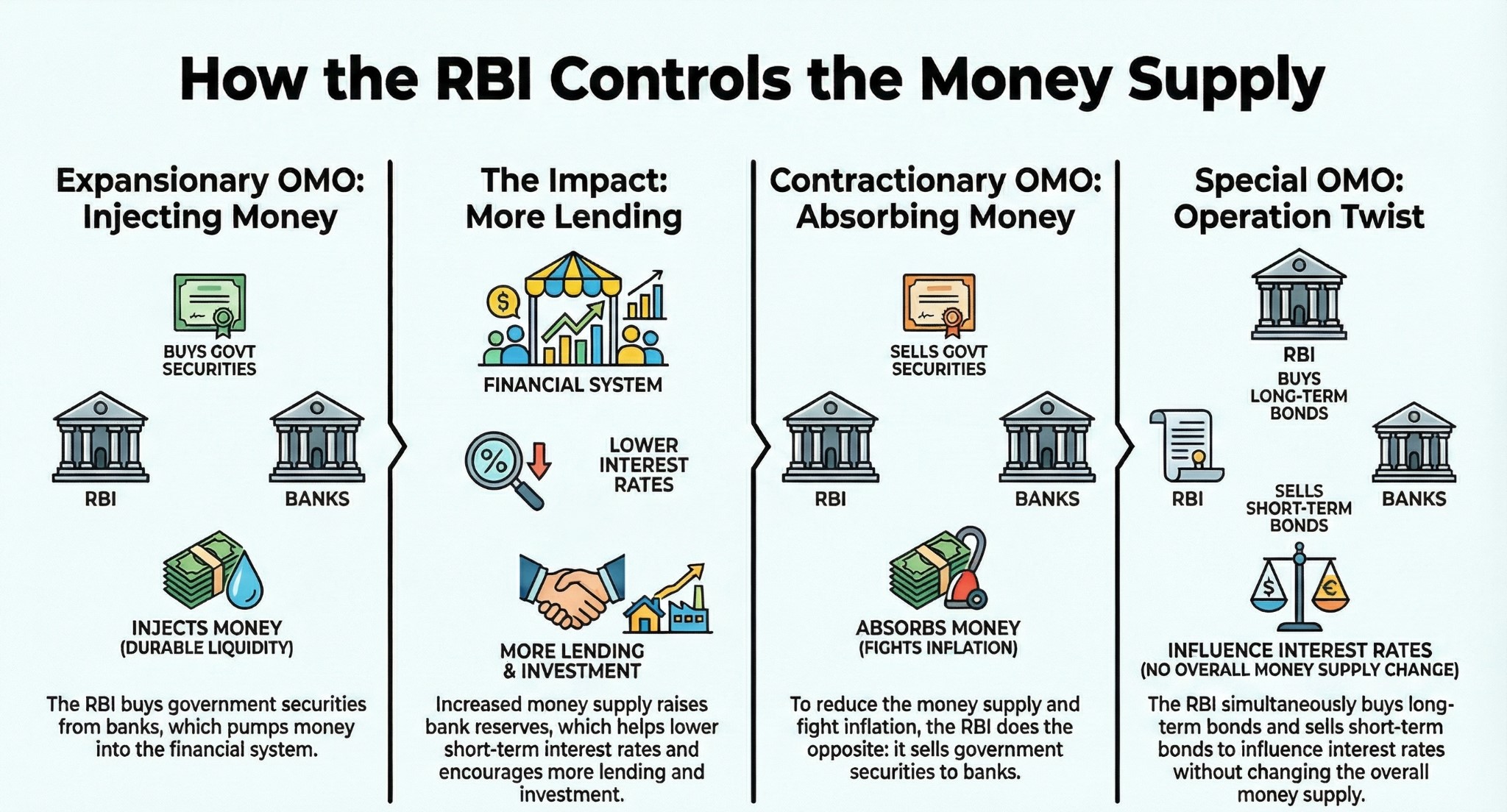

Types of Open Market Operations

1. Expansionary OMO (Liquidity Injection)

- RBI buys government securities.

- Bank reserves rise → interest rates fall → lending and investment increase.

2. Contractionary OMO (Liquidity Absorption)

- RBI sells government securities.

- Money supply falls → interest rates rise → inflationary pressures soften.

3. Special OMOs / Operation Twist

- RBI buys long-term bonds and sells short-term bonds simultaneously.

- Objective: Flatten the yield curve without altering overall system liquidity.

How OMO Purchases Work

- Assessment:

RBI tracks currency pressures, capital flows, and liquidity deficits in the banking system.

- Auction Notification:

RBI announces the purchase size (e.g., ₹1 trillion) and maturity of securities via the E-Kuber platform.

- Execution:

Banks sell government bonds to RBI; RBI credits their accounts.

- Impact:

System liquidity increases, overnight market rates soften, and government bond yields fall.

Significance of OMO Purchases

Counteracts Foreign Outflows

When foreign investors pull out of India, rupee liquidity tightens. OMO purchases help replenish this shortage.

Stabilises Bond Yields

Prevents a surge in government borrowing costs during high fiscal deficit periods.

Supports Economic Growth

Ensures banks can continue lending to key sectors such as MSMEs, industry, and housing.

Challenges of OMOs in India

1. Inflationary Risks

Excess liquidity injection may fuel demand and stoke inflation if not timed correctly.

2. Yield Curve Distortion

Heavy intervention can artificially suppress long-term yields, reducing true market risk pricing and crowding out private sector debt.

3. Transmission Delays

Banks may not reduce lending rates quickly due to high deposit costs or rigidities such as elevated small savings rates.

4. Sterilisation Costs

If liquidity becomes excessive, RBI must later absorb it via OMO sales or VRRR operations, which involves interest costs.

5. Market Dependency

Regular OMO support can make bond markets excessively reliant on RBI interventions, increasing volatility when support is withdrawn.

Recent Concerns

1. The Liquidity–Currency Dilemma

RBI must sell dollars to defend the rupee (draining liquidity), and then buy bonds via OMOs to restore liquidity. This balancing act is difficult when the rupee is already under pressure.

2. Foreign Portfolio Outflows

Geopolitical tensions and higher global interest rates continue to pull capital out of India, intensifying liquidity shortages.

3. Weak Monetary Transmission

Despite liquidity injections, MSME lending rates remain sticky, raising concerns about the effectiveness of OMOs in the current cycle.

4. Inflation vs Growth Trade-Off

Injecting liquidity supports growth but risks worsening inflation and weakening the currency, limiting the RBI’s policy flexibility.

5. Global Financial Volatility

Uncertain US Federal Reserve actions are creating large swings in capital flows, complicating RBI’s ability to plan a stable OMO schedule.

Conclusion

The RBI’s latest OMO purchase reflects the complex challenge of managing the “impossible trinity”, an independent monetary policy, a stable exchange rate, and open capital flows.

While liquidity infusion is essential to prevent a credit squeeze, the RBI must carefully calibrate its actions to ensure excess liquidity does not reignite inflation or further weaken the rupee, especially in a highly volatile global environment.