Repo Rate

16.04.2025

Repo Rate

|

For Prelims: About Repo Rate |

Why in the news?

Recently, the Reserve Bank of India (RBI) reduced the repo rate by 25 basis points, bringing it down to 6%.

About Repo Rate:

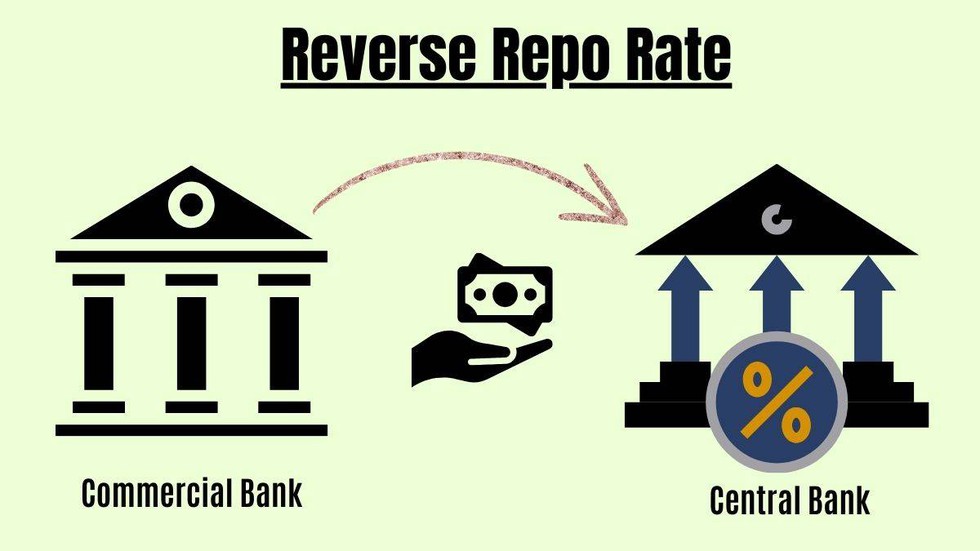

- The repo rate is the interest rate at which the RBI lends short-term funds to commercial banks against government securities.

- It serves as a primary tool for the RBI to regulate liquidity, control inflation, and influence overall economic activity.

- By adjusting the repo rate, RBI can either encourage banks to borrow more (by lowering the rate) or discourage borrowing (by raising the rate), thus influencing the money supply in the economy.

Impact of RBI Repo Rate Cut

- Lower Borrowing Costs: Commercial banks benefit from reduced borrowing costs, enabling them to offer loans at more competitive interest rates.

- Fixed Deposit (FD) Interest Rates: Banks typically lower FD rates after a repo rate cut, as their own cost of funds decreases. This means new FDs will offer lower returns, while existing FDs remain unaffected until maturity.

- Enhanced Credit Flow: Lower interest rates encourage increased borrowing by businesses and consumers, stimulating investment and consumption.

- Boost to Real Estate and Infrastructure: Due to more affordable financing options, sectors like real estate and infrastructure may see heightened activity.

- Support Amid Global Challenges: The RBI's accommodative stance aims to bolster the Indian economy against global uncertainties, such as increased U.S. tariffs impacting exports.

Source: Business Standard

What is the most likely impact of a reduction in the repo rate by the Reserve Bank of India (RBI)?

A.Decrease in money supply and rise in interest rates

B.Increase in borrowing cost for commercial banks

C.Boost to credit growth and investment in the economy

D.Fall in liquidity available with the banking system

Answer C