India’s GST Journey

India’s GST Journey

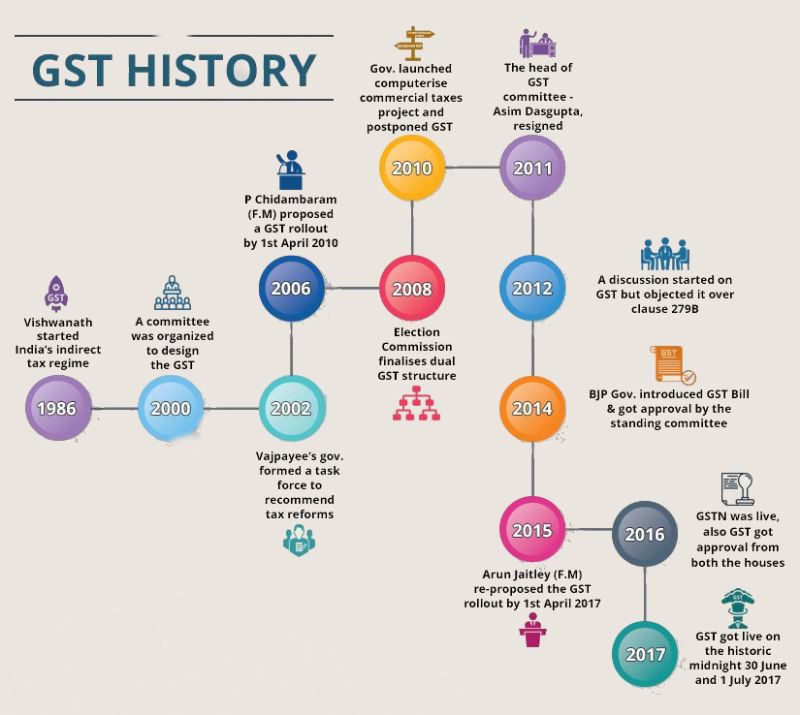

The introduction of the Goods and Services Tax (GST) in India marked a historic transformation in the country’s indirect tax system. Implemented on 1st July 2017 through the 101st Constitutional Amendment, GST represented a significant step towards economic integration and simplification of taxation. It replaced a myriad of indirect taxes levied by the Centre and states, including excise duty, value-added tax (VAT), service tax, entry tax, and luxury tax, thereby creating a single, unified tax structure across India. Administered through a dual structure, Central GST (CGST), State GST (SGST), and Integrated GST (IGST) for interstate transactions, GST has been a cornerstone of India’s reform agenda in the economy. Guided by the GST Council, a constitutional body under Article 279A, the system embodies the principles of cooperative federalism, ensuring that both the Centre and the states have a say in tax decisions.

Genesis and Implementation of GST

The launch of GST in 2017 was ambitious and transformative. It was initially implemented with seven tax slabs: 0.25%, 3%, 5%, 12%, 18%, 28%, along with a cess for sin goods. The government also introduced a five-year compensation mechanism to assure states a 14% annual growth in revenue, aimed at offsetting any initial losses due to the transition from the old tax system. The initial phase witnessed the government recalibrating rates on over 200 items, including consumer goods and services such as restaurant bills, to ease the tax burden on households. This period was critical for setting up the technological and administrative infrastructure necessary for seamless GST functioning.

Early Evolution: 2017–2022

Between 2017 and 2019, the government focused on reducing rates for essential items and services to ensure consumer relief. FMCG products, textiles, and restaurant services were moved to lower tax brackets, making GST more inclusive. From 2020 onwards, the focus shifted to improving compliance and digital governance. Introduction of e-way bills and e-invoicing, coupled with the use of analytics, enabled better tracking of transactions and curbed tax evasion. The fiscal landscape underwent a significant change in June 2022 when the state compensation mechanism ended. While the measure was planned, it created substantial fiscal stress for many states, highlighting the need for alternative revenue stabilisation measures.

The Rationale Behind GST

GST was designed to achieve multiple objectives. Firstly, it aimed to simplify the tax system by replacing a complex web of indirect taxes with a uniform structure. This reduced compliance difficulties and brought transparency to tax administration. Secondly, by allowing seamless input tax credit, GST eliminated the cascading effect of taxes, where tax is levied on previously taxed goods and services, reducing the overall cost of goods. Thirdly, GST facilitated the creation of a unified national market, reducing barriers in interstate trade, encouraging competitiveness, and supporting ease of doing business. Furthermore, GST encouraged digital governance. Online return filing, e-way bills, and electronic invoicing strengthened accountability and reduced corruption. Lastly, being consumption-based, GST ensured equity; states with higher consumption contributed more, fostering fairness across regions.

Achievements and Impact

Since its introduction, GST has demonstrated several tangible achievements. In terms of revenue mobilisation, it has consistently delivered robust collections, with average monthly receipts reaching ₹1.84 lakh crore by FY25. The tax has played a pivotal role in market integration by abolishing interstate check-posts, reducing transportation delays, and cutting logistics costs significantly. The adoption of digital tools such as e-invoicing and data analytics has improved transparency, curbing the scope for fake billing and fraud. Consumers have directly benefitted from reduced rates on essential items, while the GST Council has become an exemplar of cooperative federalism, providing a platform for joint decision-making between the Centre and states.

Challenges and Bottlenecks

Despite its successes, GST has faced structural challenges. Complexity remains a major concern, with multiple slabs and frequent rate changes leading to confusion and disputes among taxpayers. The end of the compensation scheme in 2022 has placed a strain on state finances, necessitating new mechanisms to safeguard their revenue. Compliance continues to be a hurdle, especially for micro, small, and medium enterprises (MSMEs), which struggle with filing multiple returns, refund delays, and classification issues. Additionally, certain sectors such as petroleum and alcohol remain outside GST, resulting in continued tax cascading and regional disparities in pricing. Revenue sustainability is another challenge, as the effective tax rate has declined over time, raising questions about the long-term fiscal stability of the system unless the tax base is expanded.

Path Ahead: Next-Generation Reforms

Looking forward, the government has announced “next-generation GST reforms” to be rolled out by Diwali 2025, aiming to simplify tax administration, reduce the burden on households, and ease compliance for MSMEs. One key proposal is the rationalisation of tax slabs, reducing them from the existing five to four: special (<1%), 5%, 18%, and 40% for sin goods. Such a move is expected to make GST simpler, predictable, and more business-friendly. Expanding the tax base by including petroleum and alcohol would enhance revenue collections and prevent cascading taxes in these critical sectors. A stabilisation fund is being considered to support states’ finances, ensuring federal cooperation continues smoothly. Technological interventions, including AI-driven monitoring and advanced data integration, are expected to further improve compliance, reduce evasion, and streamline refund processes.

Equity and Consumer Focus

The reforms aim to preserve equity by keeping essential items in lower tax brackets, while luxury and sin goods bear higher taxes. This approach ensures that households are not overburdened and consumption patterns are taxed fairly. By easing compliance for MSMEs and offering faster refunds, the government seeks to foster a more inclusive business environment, ultimately supporting employment and economic growth. Digital tools will continue to play a crucial role, enabling better analytics, fraud detection, and real-time monitoring of collections.

Conclusion

India’s GST journey from 2017 to 2025 reflects a story of both remarkable achievement and structural challenges. It has successfully unified the country’s indirect tax regime, enhanced revenue mobilisation, promoted transparency, and simplified the taxation system to a significant extent. However, multiple tax slabs, compliance burdens, and fiscal pressures on states continue to pose challenges. The next-generation reforms promised in 2025 aim to address these issues, rationalising rates, expanding the tax base, supporting state finances, and leveraging technology for efficient governance. GST, in its evolving form, remains central to India’s economic reforms, demonstrating the delicate balance between revenue generation, consumer welfare, and cooperative federalism.