India’s Oil Imports and Currency Depreciation

India’s Oil Imports and Currency Depreciation

India’s macroeconomic stability is deeply shaped by the performance of its currency, the Indian Rupee (₹), particularly in relation to the US Dollar (USD). Over the years, the rupee has weakened from near-parity levels to a range of ₹83–₹90 per USD. This continuous depreciation is not merely the outcome of global economic fluctuations; it is closely tied to the structural composition of India’s trade basket, which is dominated by crude oil imports. With domestic consumption heavily dependent on imported petroleum, any shift in global oil markets immediately impacts the country’s foreign exchange requirements. Understanding the complex link between oil imports and rupee depreciation is essential for framing effective policies to stabilize the currency and foster long-term economic sustainability.

Demand–Supply Dynamics and the Mechanism of Depreciation

The depreciation of the rupee can be explained fundamentally through the demand–supply forces operating in the foreign exchange market. Since most of India’s international transactions, especially imports which are denominated in US dollars, importers must purchase dollars by supplying rupees. The larger the import bill, the higher the demand for dollars, which pushes the value of the rupee downward.

Crude oil occupies the largest share of India’s import basket & around two-thirds of the total. When international crude oil prices increase, India must spend more dollars to purchase the same volume of oil. This creates a surge in dollar demand, increasing the supply of rupees in the forex market and driving the currency further downward. This depreciation, in turn, makes future oil imports even costlier, triggering a self-reinforcing cycle. Thus, the interplay between global oil prices, the structure of India’s import bill, and the foreign exchange market creates a feedback loop in which oil imports play a central role in rupee weakening.

Key Imports Shaping India’s Expanding Import Bill

India currently imports approximately 4.7 to 5 million barrels of crude oil each day (2025 estimates), fulfilling nearly 85% of its total petroleum requirement. The country’s major suppliers include Iraq, Saudi Arabia, Russia, the UAE, the United States, and African nations such as Nigeria. This diversified set of suppliers reflects India’s strategic approach to ensuring energy security amid global geopolitical realignments. Russia’s increasing share in India’s crude supply post-2022 has especially reshaped India’s oil procurement patterns.

Beyond oil, India’s import bill is inflated by large quantities of gold, fertilizers, electronics, semiconductors, chemicals, and defence machinery. Electronics and digital equipment account for a rapidly growing share because of rising digitalization and consumer demand. Fertilizer imports remain essential to support agricultural productivity, while gold continues to be imported in large quantities due to cultural and investment-driven factors. Each of these categories requires payments in US dollars, collectively contributing to persistent pressure on the rupee. As long as India’s export growth trails behind import expansion, dollar demand will continue to remain elevated.

Depreciation vs Devaluation: Understanding the Distinction

It is important to distinguish between the concepts of currency depreciation and currency devaluation. Depreciation is a natural erosion in the value of a currency due to market forces under a flexible or floating exchange rate system. Factors such as inflation differences, capital flows, trade deficits, and global volatility influence this process.

Devaluation, on the other hand, is an official reduction in the value of a currency undertaken by a government or central bank under a fixed exchange-rate regime. This is often done to boost exports by making them more competitive or to address a balance-of-payments crisis. India, however, operates under a managed float system, where the rupee is allowed to move according to market dynamics, with the central bank intervening only to curb extreme volatility. Thus, the long-term slide in the rupee’s value has been predominantly market-driven rather than a result of deliberate policy decisions.

RBI Interventions and the Influence of Capital Flows

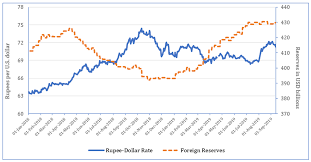

The Reserve Bank of India (RBI) plays a crucial stabilizing role in the foreign exchange market. During periods of rapid depreciation, the RBI sells dollars from its forex reserves to increase dollar supply, thereby moderating the rupee’s fall. These interventions are essential to maintaining market confidence, controlling imported inflation, and preventing panic-driven market corrections.

In addition to direct intervention, the strength of capital inflows significantly influences currency trends. Foreign direct investment (FDI), foreign portfolio investment (FPI), and substantial remittances from Non-resident Indians (NRIs) help raise the supply of dollars in the economy, thereby supporting the rupee. Government policies aimed at improving the investment climate, such as easing regulations, offering incentives to strategic sectors, and expanding manufacturing under Make in India which attract long-term capital, which strengthens currency stability. Nonetheless, reliance on short-term portfolio flows can expose the economy to sudden outflows, highlighting the need to encourage stable, long-term investments.

Strategies for Reducing Oil Import Dependence

Reducing India’s vulnerability to oil price volatility is central to stabilizing the rupee and strengthening the economy. One major step is the government’s push for ethanol blending, with a target of achieving 20% ethanol in petrol. Ethanol derived from sugarcane, maize, and agricultural residues reduces fossil fuel dependence, supports farmers, and lowers the oil import bill.

Simultaneously, India is aggressively expanding its renewable energy capacity, particularly in solar and wind power. The National Hydrogen Mission aims to make India a hub for green hydrogen, which has the potential to transform industrial energy usage. Growth in electric mobility, improved fuel efficiency, and alternative fuels such as compressed biogas also contribute to diversifying the energy mix. These long-term strategies not only curb oil imports but also reduce the current account deficit and strengthen the currency against external shocks.

Boosting Exports and Manufacturing Competitiveness

A robust export sector is essential to counter the forex pressures created by high import dependency. Greater export earnings increase foreign exchange inflows and improve the rupee’s valuation. The government’s focus on manufacturing competitiveness through the Production Linked Incentive (PLI) scheme is geared toward reducing import dependence in electronics, textiles, pharmaceuticals, defence equipment, and other strategic sectors.

Value-added exports, enhanced product diversification, improved logistics, and deeper integration into global supply chains can significantly strengthen India’s external sector. Expanding export markets and negotiating favourable trade agreements further reinforce this effort. As India’s manufacturing ecosystem strengthens, the country can steadily reduce dollar outflows and improve the rupee’s long-term stability.

Conclusion

India’s heavy reliance on imported crude oil forms the core of its currency depreciation challenge. The structural nature of this dependency amplifies dollar demand and exposes the rupee to global price volatility, creating a cycle of depreciation that affects inflation, fiscal stability, and economic growth. While RBI interventions and capital inflows provide short-term relief, long-term solutions depend on strategic reforms.

Reducing oil import dependence through renewable energy expansion, ethanol blending, fuel diversification, and technological modernization is essential. Simultaneously, strengthening domestic manufacturing, improving export competitiveness, and deepening foreign investment can provide the foundation for sustainable currency stability. A coordinated approach involving energy security, industrial growth, and macroeconomic management will be instrumental in building a resilient rupee and securing India’s economic future in an increasingly globalized world.