The Iron Ore Industry in India: Backbone of Industrial Growth

The Iron Ore Industry in India: Backbone of Industrial Growth

India's rapid infrastructure and industrial expansion hinges significantly on its mineral wealth, particularly iron ore. As the principal raw material for steel production, iron ore plays a pivotal role in the development of multiple sectors — from construction and transportation to defense and manufacturing. Contributing approximately 2.3% to the nation’s Gross Domestic Product (GDP), the iron ore industry not only underpins economic stability but also positions India strategically in the global mineral trade. This article delves deep into the structure, types, production zones, and the broader significance of the iron ore industry in India, structured under the following subheadings for clarity.

Understanding Iron Ore: Forms and Quality

Iron ore refers to naturally occurring rocks and minerals from which metallic iron (Fe) is economically extracted. These ores are found in multiple physical forms based on their size and grade. The three principal forms include:

- Lumps: These are larger chunks of ore with a high iron content, typically around 65.5% Fe, and are often used directly in blast furnaces.

- Fines: Powdery in nature, fines need sintering or pelletizing before being used in steel production.

- Pellets: These are processed spherical balls made from fines and are highly preferred in modern steel-making technologies.

The iron content or Fe percentage determines the ore's quality. Higher Fe content implies better quality and greater suitability for industrial processes. Among the various types of ores, Magnetite is the most superior with approximately 70% Fe, followed by Hematite, which contains 60–70% Fe. Limonite and Siderite, on the other hand, are of comparatively lower grades.

India’s Production Landscape: Key Statistics and Trends

India stands as one of the leading producers of iron ore in the world. The latest data from May 2025, published by state-run miner NMDC (National Mineral Development Corporation), revealed a striking 89% increase in production and sales compared to the same period in the previous year. This surge is attributed to favorable mining policies, technological improvements, and a rebound in post-pandemic infrastructure demand.

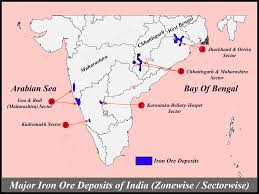

Currently, India boasts 1319 operational iron ore mines, which are distributed unevenly across the country. A staggering 97% of these mines are located in seven states: Odisha, Chhattisgarh, Karnataka, Jharkhand, Madhya Pradesh, Maharashtra, and Rajasthan. Odisha, being the richest in iron ore reserves, contributes the largest share, followed closely by Chhattisgarh and Karnataka.

Major Iron Ore Belts in India

India’s vast geography is home to several major iron ore belts that drive both domestic consumption and exports. These include:

- Odisha–Jharkhand Belt: Rich in high-grade Hematite, this belt houses mines in regions like Keonjhar, Sundargarh, and Singhbhum.

- Durg–Bastar–Chandrapur Belt (Chhattisgarh): Known for both Magnetite and Hematite ores.

- Bellary–Chitradurga–Chikmagalur Belt (Karnataka): A historic mining region, also significant for steel industries like JSW.

- Maharashtra–Goa Belt: Goa has largely low-grade ores, but its proximity to ports makes it export-friendly.

- Rajasthan Belt: Though not the largest, Rajasthan contributes considerably to the iron ore economy with reserves primarily in the Bhilwara and Udaipur districts.

Types of Iron Ore and Their Global Importance

India's geology allows for the extraction of various iron ore types, each with differing economic value and metallurgical properties:

- Magnetite: Black in color and magnetic, it is the richest ore and requires minimal processing. However, it is less commonly mined in India due to its limited reserves.

- Hematite: The most extensively mined ore in India. It is reddish in color and widely used in the steel industry.

- Limonite and Siderite: Contain less iron and are often used in lower-scale industrial applications or as blends with richer ores.

India is the second-largest producer of Hematite after Russia, highlighting its strategic place in the global mineral map. Besides Russia, the leading iron ore producing countries include Australia, Brazil, and China — nations that dominate both the quality and volume of global production.

End Uses and Industrial Applications

Iron ore’s primary use is in the production of steel, which forms the backbone of modern industrial society. Steel is indispensable in building infrastructure such as bridges, railways, skyscrapers, and highways. It is also used extensively in the manufacture of tools, automotive parts, pipes, and industrial machinery.

The link between iron ore and steel production is so intrinsic that the health of the iron ore industry directly mirrors the status of infrastructure development and economic expansion in a country. Additionally, India’s push towards self-reliance in defense and industrial production has further boosted the domestic demand for quality iron ore.

India’s Global Position and Export Markets

India is a significant player in the international iron ore trade, although its export policies vary depending on domestic demand. High-grade ores are exported primarily to China, Japan, and South Korea, which lack sufficient domestic reserves. However, government policies often prioritize domestic steel industries, especially during periods of high internal demand.

On the global stage, Australia leads in production and export, followed by Brazil. These two nations, along with India and Russia, form the core of global iron ore supply. China, although a leading producer, is also the largest importer due to its massive steel industry needs.

Challenges and Future Prospects

Despite the robust nature of India’s iron ore sector, it faces several challenges:

- Environmental concerns: Mining often leads to deforestation, habitat loss, and water pollution.

- Regulatory hurdles: Licensing, forest clearances, and local opposition can delay projects.

- Fluctuating global demand: Prices and demand are heavily influenced by international market dynamics, especially from China.

- Transport bottlenecks: Lack of seamless connectivity from mines to ports and steel plants adds to logistic costs.

However, the future remains promising. The Indian government is actively promoting exploration of untapped reserves, upgrading mining technologies, and fostering public-private partnerships to boost productivity and sustainability. Moreover, with ambitious infrastructure projects like Bharatmala, Make in India, and National Steel Policy, the demand for iron ore is expected to grow consistently.

Conclusion

The iron ore industry stands as a cornerstone of India's industrial and economic development. With rich geological endowments, a robust mining ecosystem, and a growing domestic steel industry, India is well-positioned to capitalize on its iron ore wealth. While challenges persist, strategic reforms, sustainable practices, and technological integration can unlock the sector’s full potential. As global demand for steel and infrastructure rises, India's iron ore industry will continue to play a crucial role, not just in domestic development, but also on the global economic stage.